BI Faces Interest Rate Policy Dilemma

High benchmark interest rates and weakening of the rupiah exchange rate have the potential to affect bank credit distribution.

This article has been translated using AI. See Original .

About AI Translated Article

Please note that this article was automatically translated using Microsoft Azure AI, Open AI, and Google Translation AI. We cannot ensure that the entire content is translated accurately. If you spot any errors or inconsistencies, contact us at hotline@kompas.id, and we'll make every effort to address them. Thank you for your understanding.

/https%3A%2F%2Fasset.kgnewsroom.com%2Fphoto%2Fpre%2F2024%2F03%2F20%2F60a322b7-f415-41fe-b30f-a3e0185698c5_jpg.jpg)

Bank Indonesia Governor Perry Warjiyo fielded questions from journalists at a press conference on the results of the Bank Indonesia Governor's Meeting in Jakarta on Wednesday (20/3/2024). The Bank Indonesia Governor's Meeting decided to maintain the benchmark interest rate at 6 percent.

JAKARTA, KOMPAS — The weakening of the rupiah exchange rate which tends to continue has created a dilemma in Bank Indonesia's position in making interest rate policy. Increasing interest rates will help strengthen the rupiah exchange rate. However, this step risks putting a brake on the rate of economic growth in 2024.

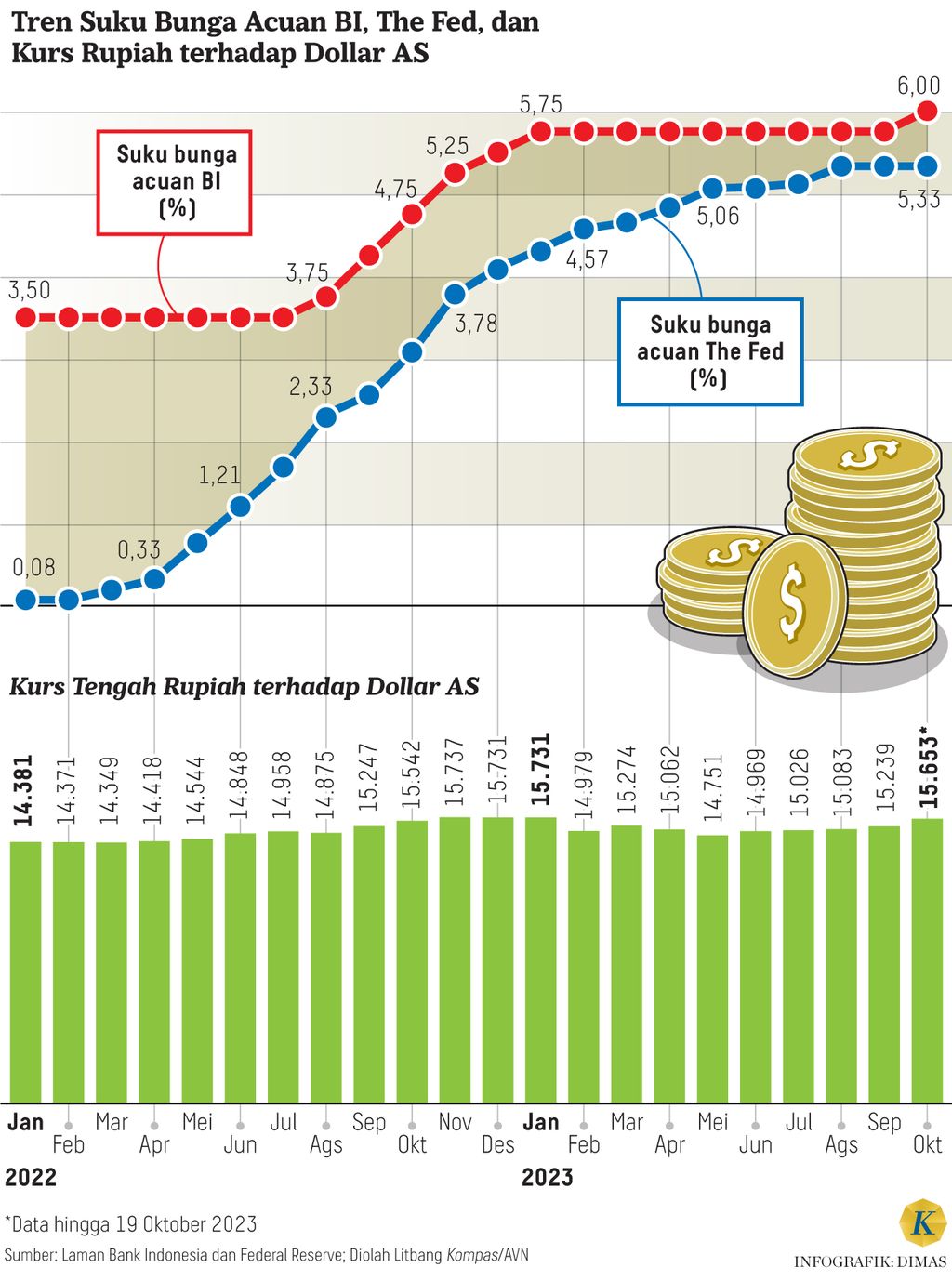

This week, Bank Indonesia (BI) held a routine Board of Governors Meeting (RDG) to discuss the dynamics of the global and domestic economy. Based on the results of the study in the previous RDG, BI is still maintaining the reference interest rate (BI Rate) at 6 percent for five consecutive months starting October 2023.

Also read: IMF: Don't Follow The Fed, Central Bank Should Focus On Domestic Inflation

The Head of Bank Permata's Economist, Josua Pardede, said that the uncertainty in the global financial market is still very high and can change drastically and quickly. The geopolitical condition in the Middle East and anticipation of the release of some data in the US are also crucial to be discussed in the BI meeting on April 23-24, 2024.

If global conditions tend to worsen accompanied by an increase in demand for safe investment instruments, Josua continued, there will be action by some investors to avoid risk (risk-off) for a long time. This will cause the rupiah to continue to weaken even if BI continues to intervene.

"There is indeed room for Bank Indonesia to raise the BI rate. We see the increase of BI rate as the last option for BI to maintain the stability of the rupiah exchange rate," he said when contacted from Jakarta on Tuesday (23/4/2024).

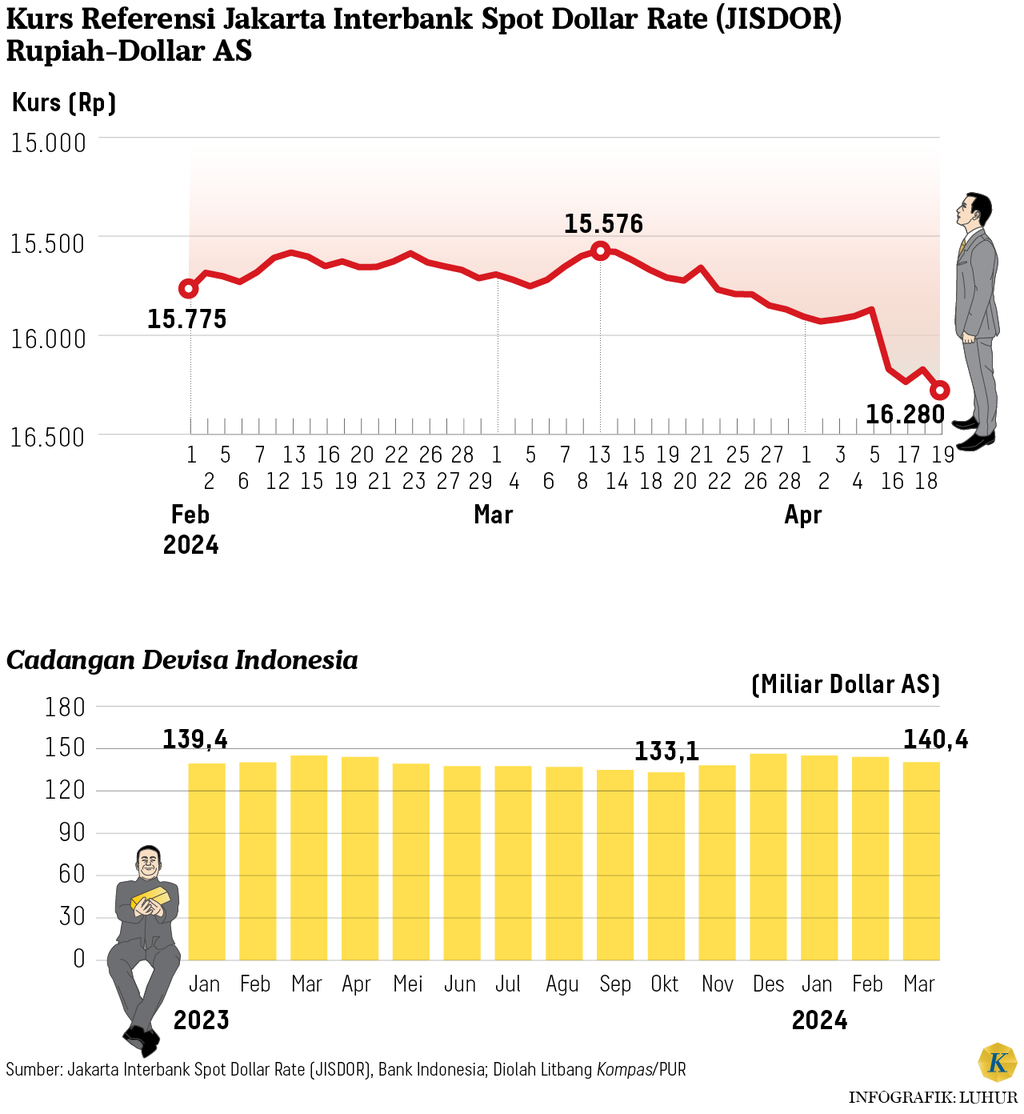

Referring to the Jakarta Interbank Spot Dollar Rate (Jisdor) data at the market's closing on Tuesday (23/4/2024), the rupiah weakened again to Rp 16,244 per US dollar or depreciated by 20 basis points compared to the previous closing. For six consecutive trading days, the rupiah has been fluctuating above the level of Rp 16,000 per US dollar.

The weakening of the rupiah was caused by external factors, namely the risk of high interest rates in the US for a longer time than initial expectations, thus triggering risk-off sentiment. This condition was caused by US economic indicator data which caused the US central bank (The Fed) to postpone reducing the benchmark interest rate.

Also read: Reuters Survey: Majority of Economists Expect Fed Interest Rates to Decline by September

Meanwhile, the internal factors that cause the weakening of the rupiah are the increase in seasonal demand for foreign currency every second quarter. This seasonal demand includes, among others, payments for principal debt, dividends, and coupons to non-residents.

Josua considers that Bank Indonesia still has strong enough ammunition to intervene in the foreign exchange market, given that foreign exchange reserves are still relatively high. However, optimizing the export earnings foreign exchange policy may need to be done in order to strengthen the foreign exchange reserve position.

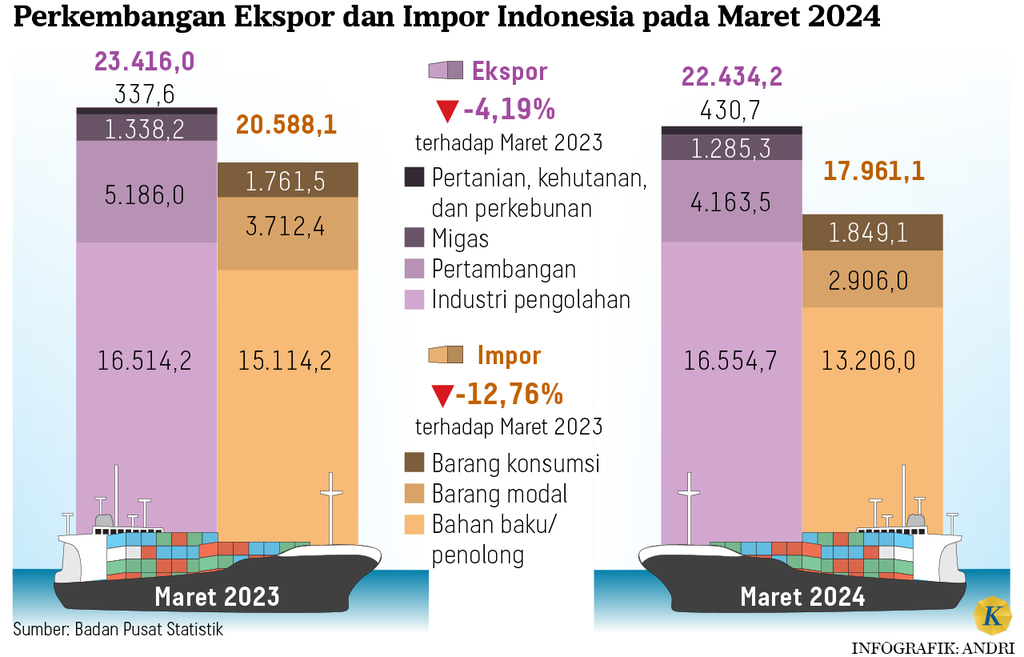

This is considering the increase in trade surplus in March 2024, which has exceeded 4 billion US dollars or the highest since February 2023, but has not had a significant impact on the Indonesian forex market. This means that not all of the surplus enters the Indonesian financial system, so the optimization of the DHE policy becomes one of the options that can be used before raising the benchmark interest rate.

According to Josua, Bank Indonesia can alleviate external pressure by raising the benchmark interest rate. This is because the yield spread of domestic financial instruments with other countries is increasingly widening, which may attract investors.

However, on the other hand, an increase in domestic benchmark interest rates can cause the burden of returns on domestic financial instruments to increase and become a burden for debt securities issuers (issuers). Apart from that, an increase in interest rates can also be transmitted to an increase in credit interest rates.

This will result in increased loan costs, ultimately leading to the potential stunting of Indonesia's economic growth. "For the BI RDG in April 2024, we anticipate that BI will likely maintain the BI-Rate at 6 percent level," said Josua.

Senior Economist and Associate Faculty at the Indonesian Banking Development Institute, Ryan Kiryanto, also predicts that the BI Rate will be maintained at the level of 6 percent. This is because of external geopolitical factors which so far do not support the central bank in easing its policies.

Furthermore, The Fed is still delaying its interest rate cut. Its execution is projected to be in September 2024. It is also possible that it will be executed in 2025. In fact, if US inflation is still difficult to control, meaning it stays above the 2 percent target until the end of 2024, The Fed may potentially increase the benchmark interest rate by 25 basis points to 5.5-5.75 percent.

Also read: Era of High Interest Rates Continues, Banks Consider Adjustments

In addition, the benchmark interest rates in Europe still average around 4.5-5.5% due to the 2% inflation target not having been achieved yet. "For the purpose of continuing efforts to stabilize the economy and the monetary situation domestically, namely controlled inflation and stability of the rupiah exchange rate, the best available option is to maintain the BI-Rate," said Ryan.

Ryan added that if The Fed raises its benchmark interest rate and inflation in Indonesia tends to rise towards 3.5-4 percent, BI has room to increase its benchmark interest rate. However, in the short term, maintaining the benchmark interest rate at 6 percent is a reasonable, precise, and anticipatory step.

CIMB Niaga President Director Lani Darmawan (right) chats with Kompas Gramedia CEO Liliek Oetama during a visit to the Kompas Daily Editorial office, Jakarta, Friday (6/10/2023).

The President Director of PT Bank CIMB Niaga Tbk, Lani Darmawan, stated on Tuesday (23/4/2024) that the high interest rates have the potential to slow down credit growth. Therefore, he hopes that the relevant authorities and regulators can make the right decisions.

"We believe the government and regulators will make the best decisions. If interest rates remain high and also if the rupiah exchange rate remains weak, it is estimated that loan (credit) growth will slow down. "This is what banks must anticipate," he said.

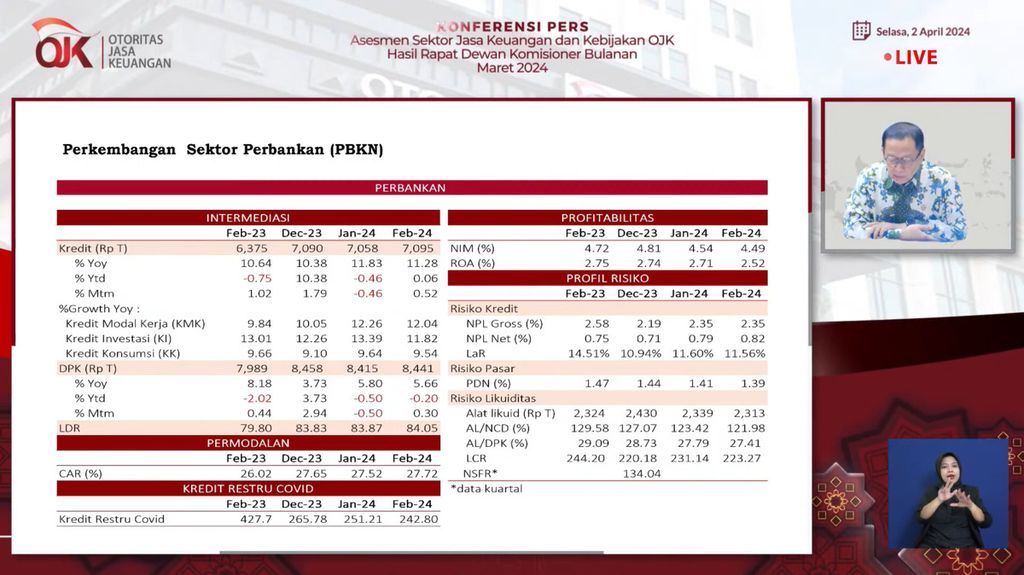

Based on data from the Financial Services Authority (OJK), credit distribution by the banking industry in February 2024 grew 11.28 percent on an annual basis to IDR 7,095 trillion. On a monthly basis, credit distribution in February 2024 grew 0.52 percent or lower than February 2023 which grew 1.02 percent.

Credit distribution by the banking industry in February 2024 grew 11.28 percent on an annual basis to IDR 7,095 trillion.

The President Director of PT Bank Central Asia (BCA) Tbk, Jahja Setiaatmadja, hopes that BI's policy can maintain the stability of the rupiah exchange rate. This is important when The Fed signals a delay in lowering benchmark interest rates in the US. "Our hope is that the rupiah exchange rate can be well managed," he said.

In a press conference on Monday (22/4/2024), Jahja explained that The Fed is unlikely to lower its benchmark interest rate in the near future. This will result in other countries, including Indonesia, not lowering their benchmark interest rates before there is certainty from The Fed, as it risks weakening the exchange rate.

Executive Head of Banking Supervision at the Financial Services Authority (OJK), Dian Ediana Rae, explained the development of the banking sector during the OJK's Monthly Commissioner Meeting in March 2024, held online on Tuesday (2/4/2024).

Executive Vice President of Corporate Communication and Social Responsibility at BCA, Hera F. Haryn, added that the movement of The Fed's interest rates will certainly have an impact on BI's interest rates. However, this will depend heavily on various other factors, such as the difference in interest rates between the US and Indonesia, trends in global capital flows, and currency exchange rates.

"BCA always pays close attention to developments in Bank Indonesia interest rates as well as macroeconomic dynamics and banking sector liquidity conditions in determining future interest rate policies on both the credit and deposit sides. "We hope that Indonesia's economic growth will remain positive in 2024, thereby supporting the growth of national banking credit and funding," said Hera.

Also read: Capital Market Players Anticipate BI Monetary Policy

Meanwhile, President Director of CIMB Niaga Finance (CNAF) Ristiawan Suherman believes that the increase in interest rates to maintain the value of the rupiah can have an impact on the increase in financing costs. This will also cause a decrease in the purchasing power of the community.

Furthermore, the current exchange rate movement of the rupiah is worrying due to its instability and tendency to weaken. If the interest rates are raised, the pace of the community's economy will be hindered.

"Until now, the exchange rate movement has not yet impacted car prices, so it is expected that with stable or fixed interest rates, it can drive economic growth, especially for the financing industry," he said.